Renters Insurance Report: COVID-19 Part 3

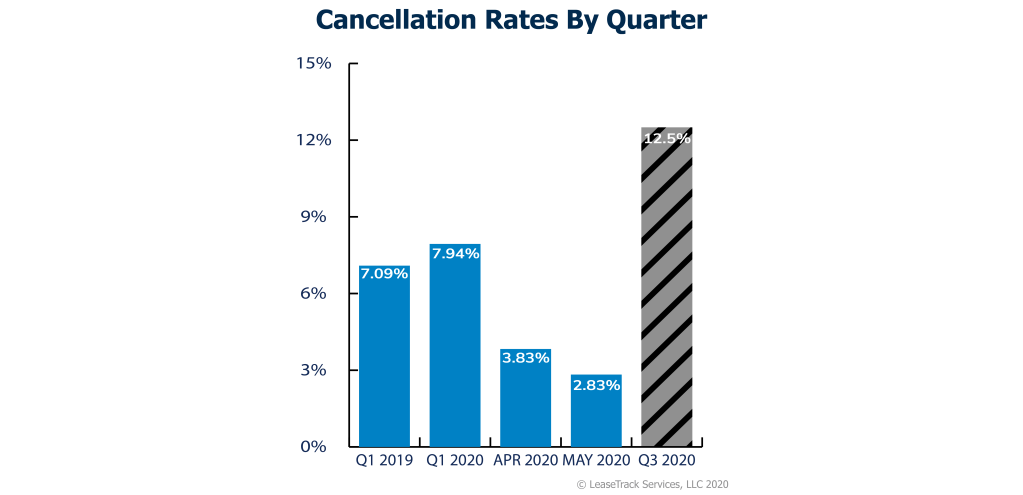

COVID-19 has impacted the the entire US economy, and for single- and multi-family industries, the impact on renters insurance is still being assessed. LeaseTrack analyzed over 25,000 rental properties and discovered renters insurance cancellation rates are the lowest they’ve been in over a decade. Cancellations will come due as financial assistance programs end, leading to a flood of uncovered losses and more risk for property owners.

Summary

"We will suspend cancellation and nonrenewal of coverage due to nonpayment through June 15, 2020"

-Traveler's Insurance Tweet

Preparing for Q3 Cancellations

Taking into account the pre-pandemic cancellation trends, and considering the historic lows of April 2020, LeaseTrack projects an average cancellation rate of 15%+ starting in Q3 2020.

With cancellations looming on the horizon, and the current hard market, it is now more important than ever to have a clear view of lease compliance at both the portfolio and property level.

About LeaseTrack

Founded in 2019 to provide property owners the tools to reduce resident risk and increase lease compliance, LeaseTrack is the market leader in lease abstraction software. The company was born out of a decade of data from our parent company, Effective Coverage, the #1 writer of renters insurance through Travelers in the country. LeaseTrack provides a unique lens into the resident risk management space with insights provided from our proprietary tracking data and multiple partnerships in the renters insurance space.

To learn more about LeaseTrack, visit our about page, or call 800.430.8075