Renters Insurance Report: COVID-19 Part 1

The impact of the COVID-19 pandemic is already having an effect on renters insurance. At the end of Q1 2020, cancellation rates were on the rise until the pandemic struck, forcing carriers to suspend cancellations. We expect cancellation rates in the second quarter to plummet, with the trend then reversing and leading to a tsunami of uncovered losses in the third and fourth quarters.

Summary

LeaseTrack has a unique lens into resident risk management through our multiple business channels, and we conducted a study across 25,000 rental properties to analyze the volume of renters insurance policy cancellations. We found cancellation rates have risen steadily, up 11.9% in Q1 2020 vs Q1 2019.

Cancellation rates were continuing to trend upwards with no signs of slowing down until the COVID-19 pandemic struck. Insurance companies offered premium deferment programs at the end of March. Many states followed suit in April by requiring premium deferments.

"Consumers and small businesses experiencing financial hardship due to COVID-19 may defer paying premiums for property and casualty insurance for 60 days."

-Department of Financial Services, NY

Tweet

Cancellation rates have slowed significantly since the beginning of the COVID-19 pandemic due to economic hardship assistance programs for policyholders. But cancellations are certain to pick back up again, and once they do, property owners will be exposed to risks that should be the tenant’s responsibility and covered by renters insurance.

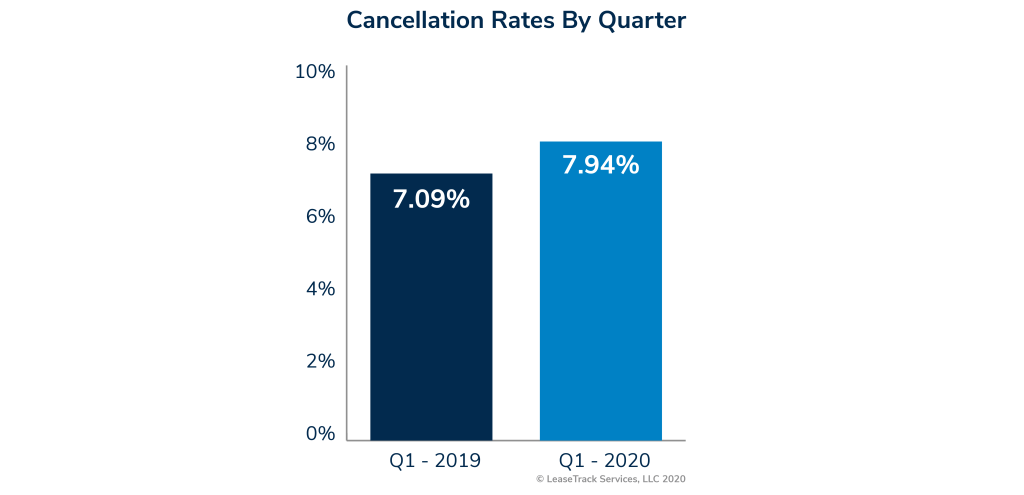

Cancellation Rates By Quarter

Q1 2020 had an overall cancellation rate of 7.94%, compared with a cancellation rate of 7.09% in Q1 2019, indicating an upward trend for cancellations. The difference of a year yields a change of 11.9%, which has been the largest increase of any quarter over the past 5 years. This trend was cause for concern until the COVID-19 pandemic brought cancellations to a halt.

Early reporting of our April numbers shows cancellation rates at their lowest level in a decade.

Historically, we have run our renters insurance report based on quarterly figures, ignoring the volatility of monthly transactions. For example, in 2020, the extra day associated with leap year drove an increased cancellation rate in February. However, when normalized over the course of 90 days, this cancellation rate was in line with expectations.

Q1 2020 vs. Q2 2019 saw an overall increase of .85%, indicating that residents will continue to cancel policies, despite being required to keep them in force.

"Given the impact of COVID-19, LeaseTrack will issue a follow up to this report for April 2020 data."

Eric Narcisco, CEO LeaseTrack Tweet

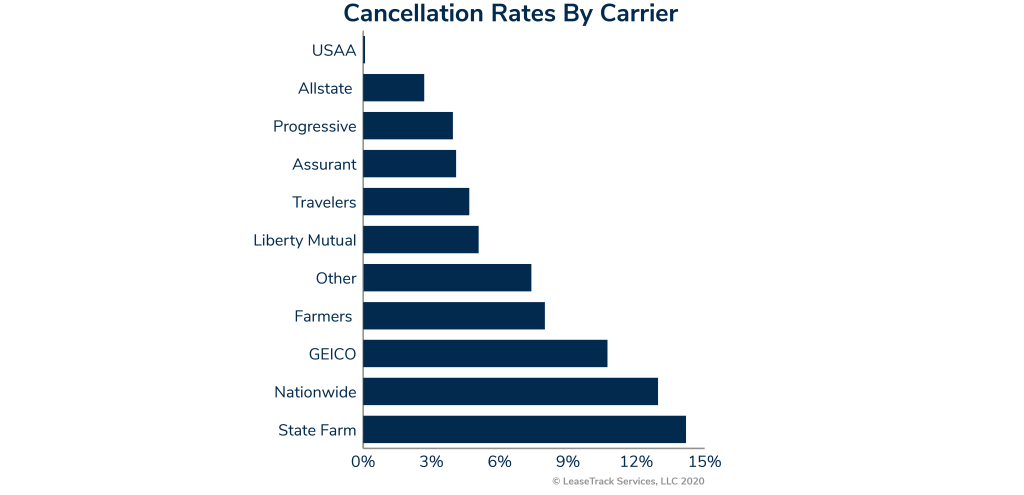

Carrier Impact on Cancellation Rate

It is expected that the average monthly cancellation rate will be under 4% at the close of April 2020, based on most carriers extending deferment options to policyholders. Based on this data, it is predicted that an increase in cancellations will be seen at the end of Q2 and the beginning of Q3, when the payment deferments reach a close. This reporting will be available the first week in May.